Solutions for Private Equity

Covering each phase of the Deal Flow

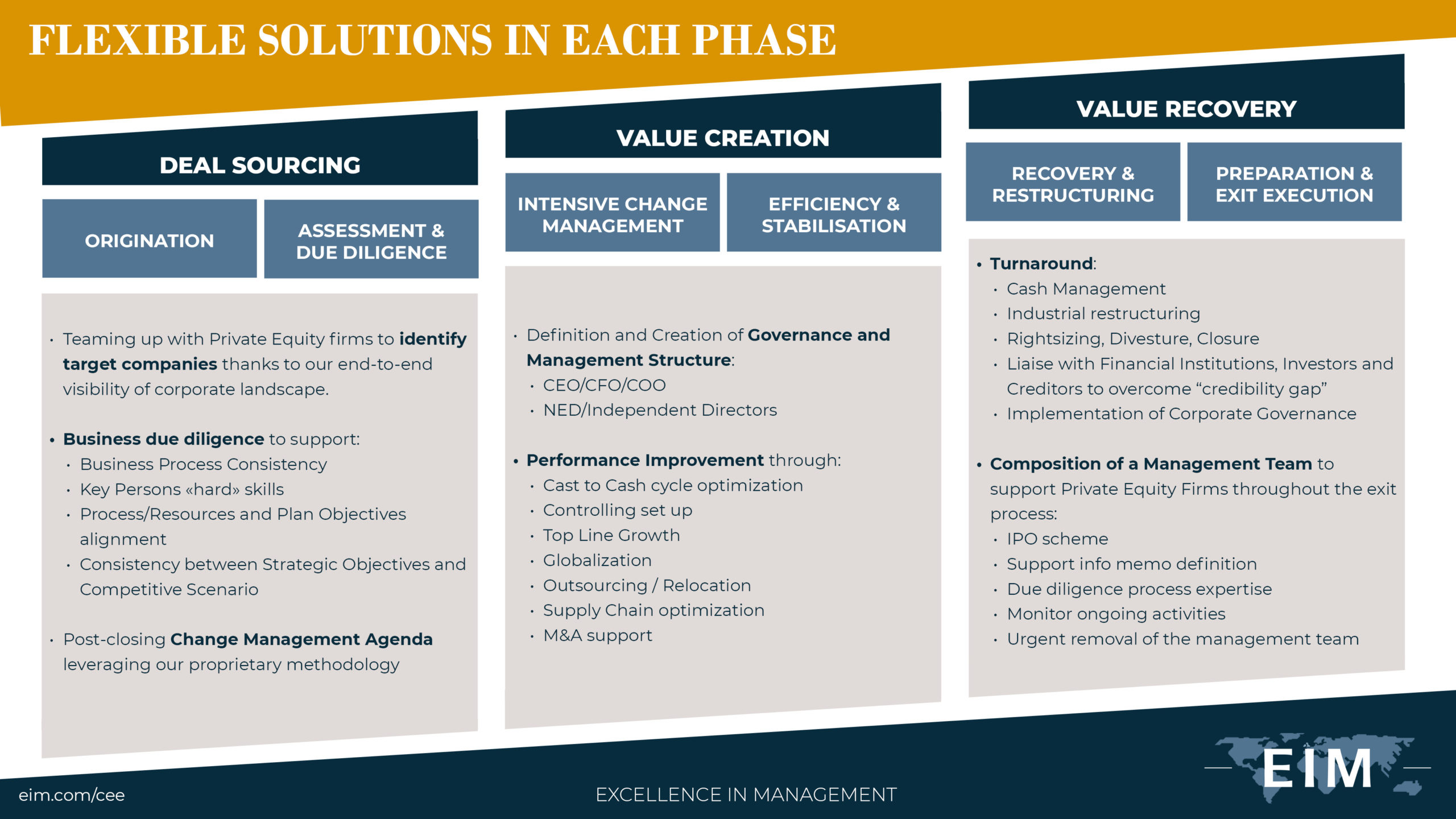

EIM enhances value by providing the best management solution at every phase of a private equity transaction: whether deal sourcing, evaluating, merging, building or selling a portfolio company.

We provide immediately available C-level management resources and skills of a proven high-caliber, overqualified executives to identify and unlock the performance potential, or to manage a period of transition, crisis or change within an organization on an interim, permanent, consulting or a NED basis. Worldwide.

Deal Sourcing

We detect hidden deal opportunities for your investments or add-ons for your buy & build strategy in the markets, that are not yet in the hands of M&A advisors.

EIM Partners in 25 offices, all operating as one integrated firm, together with our Advisory Board have an excellent market overview on an internatinal level.

Our Interim Chief Restructuring Officers, Interim Chief Executive Officers and Interim Chief Finance Officers shape the future of corporations for the next 5-7 years.

Deal Sourcing

We detect hidden deal opportunities for your investments or add-ons for your buy & build strategy in the markets, that are not yet in the hands of M&A advisors.

EIM Partners in 25 offices, all operating as one integrated firm, together with our Advisory Board have an excellent market overview on an internatinal level.

Our Interim Chief Restructuring Officers, Interim Chief Executive Officers and Interim Chief Finance Officers shape the future of corporations for the next 5-7 years.

Evaluating a potential

portfolio company

First, in evaluating a potential portfolio company and its management and operations, the challenge is often to obtain intrinsic and unique proprietary information to best assess present and future enterprise value. EIM provides talented experts with appropriate business knowledge who will assess the management team, the operational processes and the specific business issues, sometimes with experience from within the portfolio company. EIM can also provide a NED to prepare an acquisition, or a CEO for a Management Buy-In.

Evaluating a portfolio company

First, in evaluating a potential portfolio company and its management and operations, the challenge is often to obtain intrinsic and unique proprietary information to best assess present and future enterprise value. EIM provides talented experts with appropriate business knowledge who will assess the management team, the operational processes and the specific business issues, sometimes with experience from within the portfolio company. EIM can also provide a NED to prepare an acquisition, or a CEO for a Management Buy-In.

Post Acquisition Integration

EIM creates or realigns change management strategies which aim to align People, Processes and Technology with the company’s strategy or vision.

Consequent implementation of a prepared strategic framework is the key to achieve lasting results. To successfully master such a complex challenge, you need to have broad but specific experience, use high level of creativity and tirelessly implement changes at a high speed.

Post-merger integration is a complex process of combining and aligning of companies to achieve the planned merger synergies.

We offer you seasoned experts capable of integrating multi-cultural companies, design and realize operational programs to use the full potential of the newly merged companies.

Post Acquisition Integration

EIM creates or realigns change management strategies which aim to align People, Processes and Technology with the company’s strategy or vision.

Consequent implementation of a prepared strategic framework is the key to achieve lasting results. To successfully master such a complex challenge, you need to have broad but specific experience, use high level of creativity and tirelessly implement changes at a high speed.

Post-merger integration is a complex process of combining and aligning of companies to achieve the planned merger synergies.

We offer you seasoned experts capable of integrating multi-cultural companies, design and realize operational programs to use the full potential of the newly merged companies.

Building a portfolio company

Secondly, in owning a portfolio company, EIM assists by providing executive resourcing for performance improvement or turnaround solutions. Interim or permanently placed executives provided by EIM will support, coach or replace the management team at short notice, when time is critical.

is the average number of days within EIM presents suitable profiles

%

of interim mandate projects are filled

%

of goals set are achieved - on time and within budget

%

of permanent mandate projects are filled

is the average number of days within EIM presents suitable profiles

%

of interim mandate projects are filled

%

of goals set are achieved - on time and within budget

%

of permanent mandate projects are filled

Bulding a portfolio company

Secondly, in owning a portfolio company, EIM assists by providing executive resourcing for performance improvement or turnaround solutions. Interim or permanently placed executives provided by EIM will support, coach or replace the management team at short notice, when time is critical.

Selling a portfolio company

Finally, in selling a portfolio company, the management team often needs to be balanced for best value at exit. In short, EIM offers management solutions to prepare for a listing or management to assist in the exit transaction itself. Finally, EIM makes sure that management is aligned with the owner’s and/or seller’s agenda.

Selling a portfolio company

Finally, in selling a portfolio company, the management team often needs to be balanced for best value at exit. In short, EIM offers management solutions to prepare for a listing or management to assist in the exit transaction itself. Finally, EIM makes sure that management is aligned with the owner’s and/or seller’s agenda.

Let’s talk about it together. As an advisor to a Fund of Funds with more than 1bnEur under management in the CEE Region, I will carefully listen to your story.

EIM Executive Interim Management CEE

Together we can find the solution you are looking for

EIM Executive Interim Management AG is the Holding Company of the EIM Group and is owned by the Equity Partners of EIM Group.

It directly controls every EIM office, it owns the EIM, EIM Excellence in Management and EIM Executive Interim Management brands, and manages the licensing of its intellectual property to its subsidiaries.

© EIM Executive Interim Management CEE s.r.o. | Pasienkova 2H | 821 06 Bratislava | Data Privacy