DOING BUSINESS IN BULGARIA

WHY BULGARIA

1. Political and business stability

- Bulgaria is a member of the European Union, NATO and WTO

- The stability of the currency is supported by the currency board, pegging the Bulgarian lev to the euro at the level of 1.96

2. Strategic Location

- Located at the heart of the Balkans, Bulgaria is a strategic logistics hub. Ease of transportation of cargo is provided by:

- Five Pan-European corridors ( IV, VII, VII, XI, X), which pass through the country

- Transport program TRACECA, which connects Europe with Caucasian and Central Asian region

- Four major airports: Sofia, Plovdiv, Bourgas and Varna

- Two main seaports: Varna and Bourgas

- Numerous ports at the Danube River

3. Access to Markets

- Due to its location Bulgaria provides direct access to the following key markets:

- European Union – zero tariff market with population of 500 million

- CIS – still not well penetrated market with a high potential

- Turkey – zero tariff market of near 80 million population

- Middle East – a market with high purchasing power

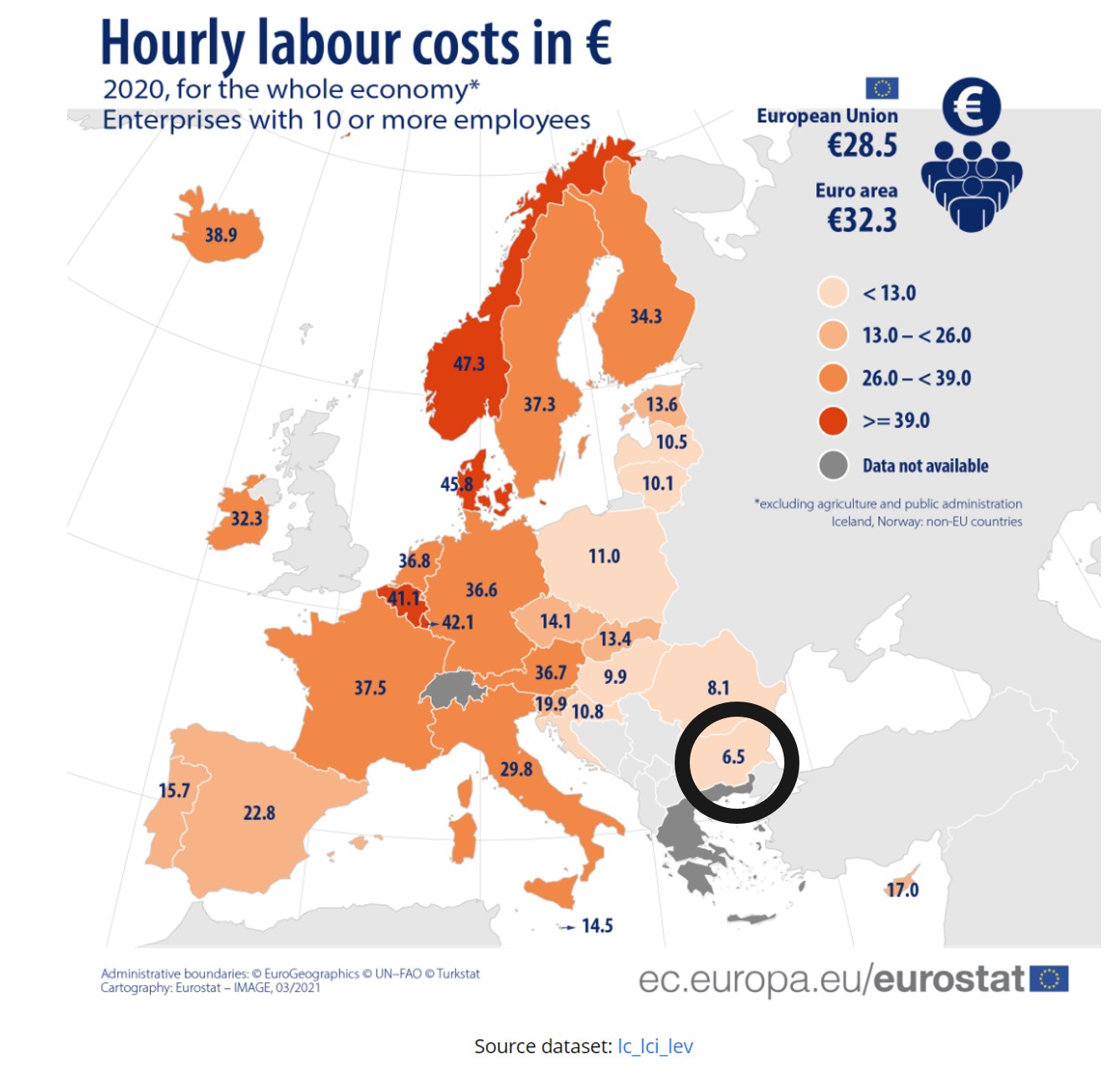

4. Human Resources

- Work force is well educated, highly skilled and multilingual

- 62.2 % of the total population is in working age (appr. 4.6 million)

- 60 000 students annually graduate from 51 universities

- 98% of the high school students study a foreign language (usually English) and 73% study a second language (mainly German, French, Spanish, Russian)

- 94% of the schools have Internet access

- One of the more compelling statistics about the state of Bulgaria’s education is that more than two-thirds of students study English.

- Moreover, the curricula at more than 100 high schools are taught in a foreign language. Increasingly, given the lower costs of study and living,

- Bulgaria is also attracting a lot of international students, with more than 10,000 non-native students enrolled in domestic universities or colleges.

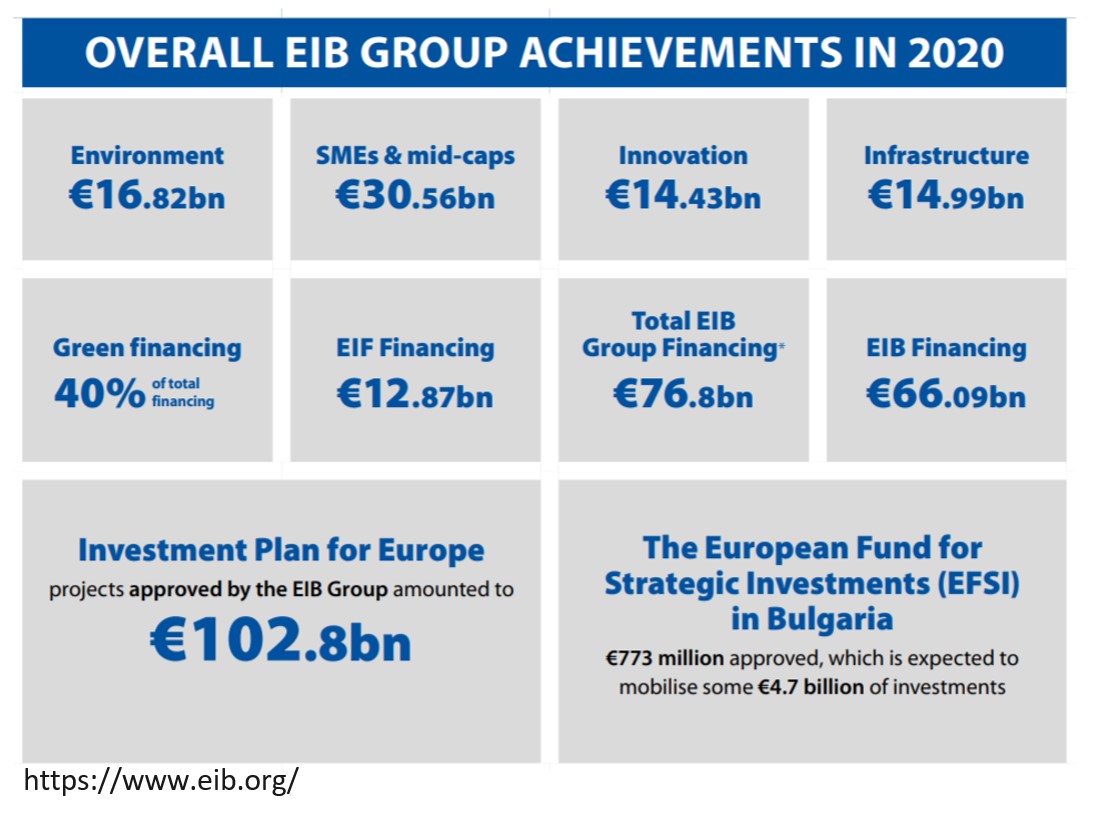

5. Support for Certified Investors

As part of the EU’s multi-billion-euro scheme to fund development in several key industries, the Bulgarian government provides funding support for certain sectors. The Investment Promotion Act (IPA) invests in research and development, high-tech services, warehousing and logistics, and manufacturing, as well as other crucial industries. In addition, certified investors also receive a wide variety of benefits, including participation in a priority investing scheme.

Here are just some of the advantages of these schemes:

- Shortened administrative procedures.

- Financial support for education and professional training.

- Infrastructure subsidies.

- Priority purchasing of state or municipal land.

Our Local and International Interim Managers already supported companies and Private Equity Funds in:

- Due diligence before acquisition

- Greenfield

- Brownfield

- Relocation of production

- Performance Improvement / Lean

- Governance and Transparency

- ERP/ SAP Implementation

- Digital Transformation

- Market entry

- Business Development

- Sales Channels and Market Approach

6. Investment Promotion Act

The 2004 Investment Promotion Act (revised in 2018) stipulates equal treatment of foreign and domestic investors.

The law encourages investment in manufacturing, services, high technology, education, and human resource development via a range of incentives, which include:

- helping investors purchase municipal or state-owned land without tender,

- providing state financing for basic infrastructure and for training new staff, and

- reimbursing the employer’s portion of social security payments.

The law also provides tax incentives and fast-track administrative procedures for public-private partnerships. Priority investors may receive incentives such as

- below-market prices when acquiring property rights (full or limited) from the central or municipal government,

- government grants for research and development (R&D) and education projects, and

- institutional support for establishing PPPs.

Additional investment incentives include a

- two-year valued-added tax (VAT) exemption on equipment imports for investment projects over EUR 2.5 million, provided the project will be implemented within a two-year period and create at least 20 new jobs.

- Corporate income tax exemption can also be granted for manufacturing projects, with no minimum investment requirement, that are implemented in high unemployment areas (25 percent higher than average nationwide unemployment) and create at least 10 jobs, of which at least fifty percent are created in productive sector.

7. Foreign Trade Zones/Free Ports/Trade Facilitation

- EU integration encouraged local authorities to seek partnerships with the private sector and provide resources (i.e., land, infrastructure, etc.) for the development of industrial zones and technological parks.

- The Trakia Economic Zone in south-central Bulgaria is one of the largest industrial area in Southeast Europe, attracting over EUR 2 billion in investment and sustaining over 30,000 jobs.

- In addition, the state-owned National Industrial Zones Company (NIZC) currently operates fully functioning industrial zones in Sofia, Burgas, Vidin, Ruse, Svilengrad, Stara Zagora and Varna.

- Under construction are future industrial zones in Suvorovo (Varna), Telish (Pleven), Kardzhali and Karlovo.

- Investors in these economic zones benefit from established infrastructure, location, and transport logistics. The common thread among all these economic zones is that they are either located in regions with sufficient available labor, in poor regions where the government provides special investment incentives, or at important cross-border junctures.

Interested in doing business in the CEE Region? Check our dedicated page for Romania

Let’s discuss the opportunities together

EIM Executive Interim Management CEE

Together we can find the solution you are looking for